Our County Commission needs to implement TRUE Impact Fees

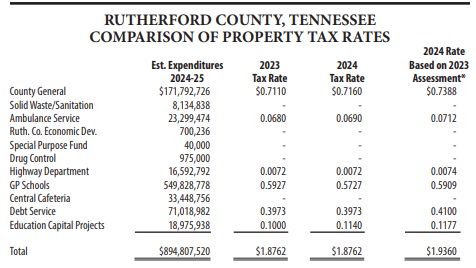

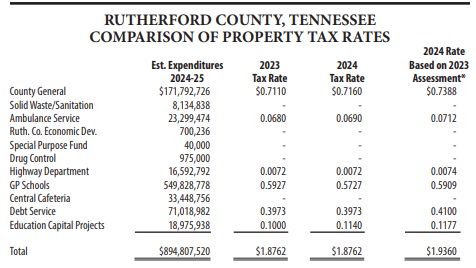

Key Passages: "Property taxes are increasing by a healthy 8.6% year over year due to growth in the overall levy and lower debt service requirements" and "Summary

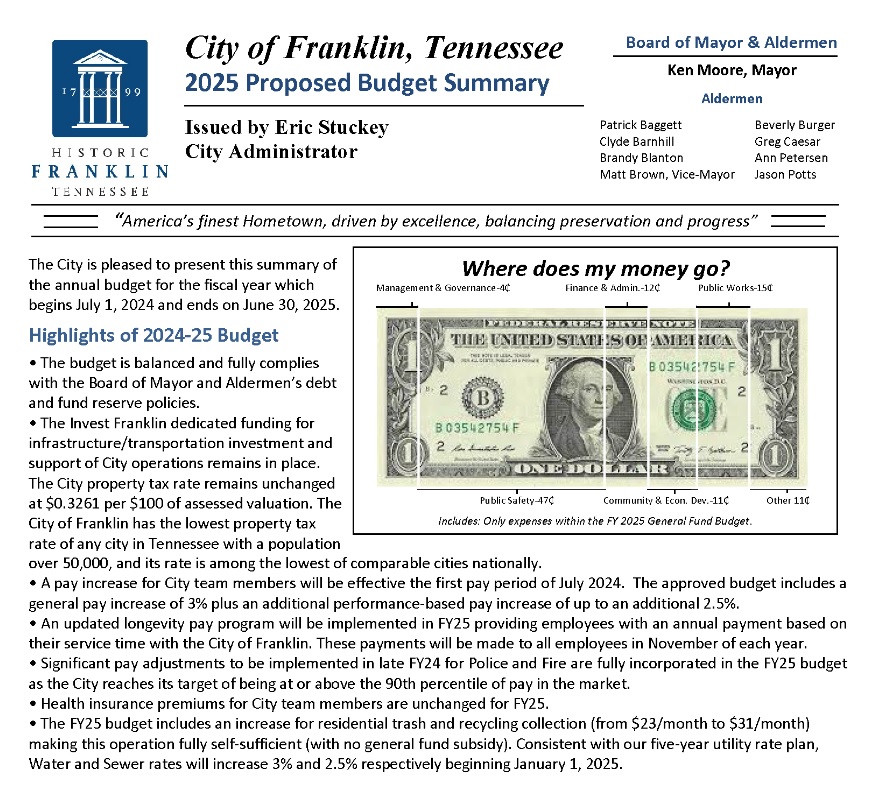

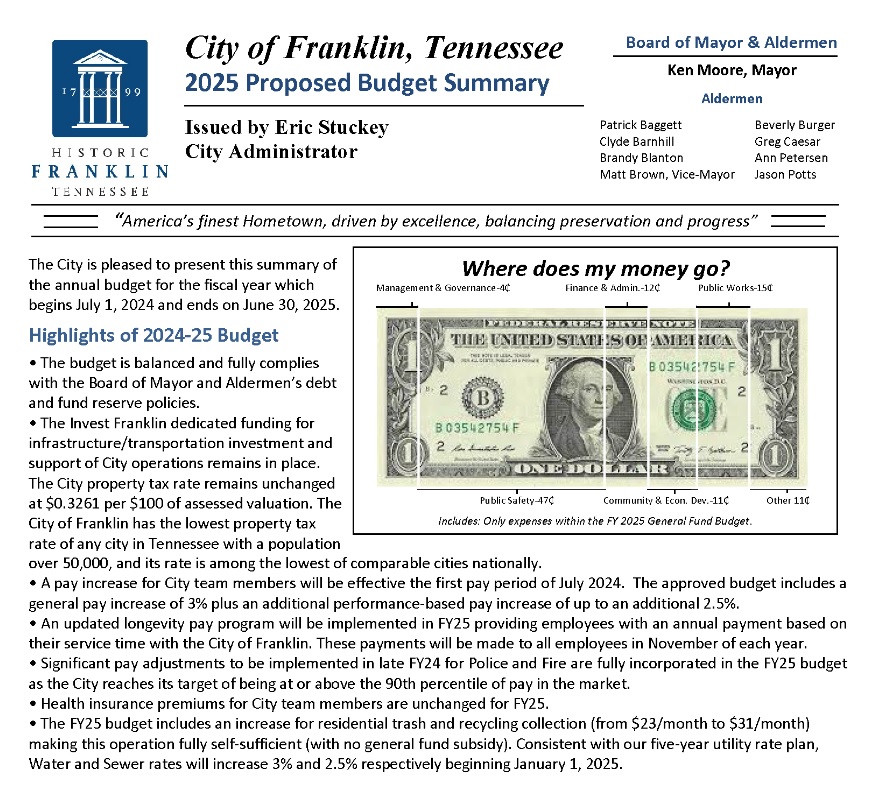

Despite the challenges and uncertainty facing communities across the country, the City of Franklin is in excellent

financial condition. Our reserves are at strong levels, our debt obligations are relatively low and manageable, and our

tax rates are among the lowest in America"

Franklin City Schools is consistently #1 in the State in Local Spending Per Student. Rutherford County was 120th out of 143 Schools Systems in 2022-2023 School Year